Understanding Mountain West Bank: A Deep Dive Into Its Role and Impact

Mountain West Bank is one of those financial institutions that often fly under the radar for many people. However, for those familiar with it, the bank offers a unique set of services that blend the convenience of modern banking with the local touch of a community-based institution. Whether you’re an individual looking for a trusted place to manage your finances, a business seeking loans or resources, or someone interested in understanding the bank’s impact on the local economy, Mountain West Bank provides a variety of financial solutions.

In this article, we’re going to explore it its history, services, growth, and role in the financial landscape. Let’s dive in and uncover what makes Mountain West Bank stand out.

The History of Mountain West Bank: A Legacy Built on Trust

Mountain West Bank story goes back several decades, and its growth reflects the changing dynamics of banking and the financial services industry. The bank’s origins trace back to its founding as a small community bank, with a focus on providing services tailored to the needs of residents and businesses.

The bank has always prided itself on offering personalized services that prioritize the financial health of its customers. Over the years, it has grown from a small bank serving local communities to a more extensive network that has expanded its reach, offering a variety of services designed to meet the evolving demands of customers.

The core philosophy that guided it from its early days has remained the same—building lasting relationships with customers and fostering trust through transparent, ethical, and effective banking practices. This commitment to customer service, paired with a deep understanding of the local economy, has allowed Mountain West Bank to thrive and build a solid reputation in its industry.

Services Offered by Mountain West Bank: A Comprehensive Range for Everyone

One of the defining features of Mountain West Bank is the wide array of financial services it offers. These services cater to individuals, businesses, and even non-profit organizations. From simple checking and savings accounts to more complex business loans and investment services, Mountain West Bank provides solutions for a diverse set of financial needs.

Personal Banking

For individual customers, Mountain West Bank provides a range of banking products designed to make managing finances simple and efficient. This includes traditional checking and savings accounts, credit cards, and loans. The bank’s loan offerings can help individuals finance everything from home improvements to education, making it an accessible option for many.

The online and mobile banking services offered by Mountain West Bank ensure that customers can manage their finances on the go. The ability to pay bills, transfer funds, check account balances, and view transaction histories with ease has become increasingly important in today’s fast-paced world. The bank’s online platform is user-friendly, ensuring that even those less familiar with technology can navigate it comfortably.

Business Banking

Mountain West Bank doesn’t just cater to individuals; it also provides a suite of services designed specifically for businesses. Whether you’re a small startup or a well-established company, Mountain West Bank offers solutions to streamline business operations and facilitate growth.

Some of the key business banking services include business checking and savings accounts, merchant services, business loans, and lines of credit. These services are vital for businesses that need financial support to manage day-to-day operations or to fuel expansion. The bank’s business loans, in particular, have been instrumental in helping many local businesses scale their operations or navigate economic challenges.

Mountain West Bank also offers tailored services for industries such as agriculture, real estate, and construction. This allows businesses in niche sectors to receive specialized financial support based on their unique needs.

The Bank’s Expansion and Growth Over Time

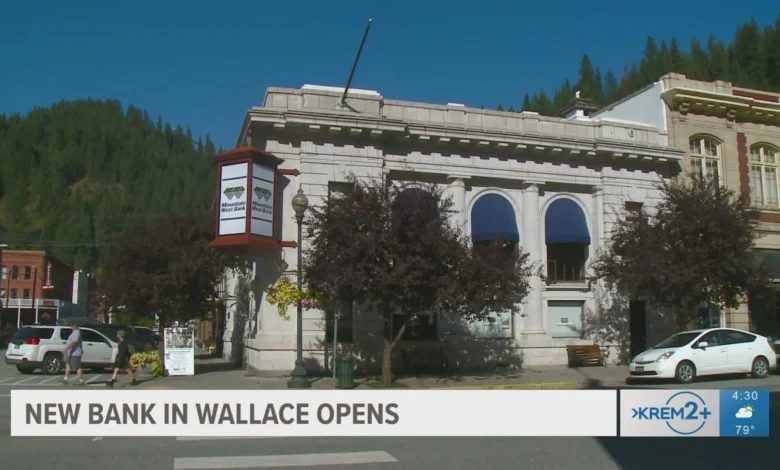

Mountain West Bank has come a long way since its early days, expanding both its physical footprint and its service offerings. The bank has grown to include multiple branches across the region, each one designed to meet the specific needs of its community.

The bank’s expansion strategy focuses on maintaining a balance between offering high-quality customer service and scaling operations to meet growing demand. As it has expanded, Mountain West Bank has also embraced modern banking technology, investing in online and mobile platforms that provide customers with convenient access to their accounts.

With each new location, the bank has continued to prioritize customer relationships, ensuring that even as it grows, the personalized service that customers value remains a key feature.

Mountain West Bank’s Role in the Local Economy

Mountain West Bank’s impact goes beyond the realm of personal banking and business services. The bank plays a critical role in supporting the local economy through its lending practices and community engagement.

By offering loans to individuals, businesses, and local projects, the bank helps to drive economic development in the areas it serves. Many local businesses rely on Mountain West Bank for financing, which enables them to grow, hire more employees, and contribute to the regional economy. The bank’s focus on community development has also led to support for various local charities, educational initiatives, and non-profit organizations.

Mountain West Bank understands the importance of fostering a strong, vibrant community, and its role in supporting local projects and initiatives has helped make it a trusted pillar of the region’s economic landscape.

Customer-Centric Approach: The Heart of Mountain West Bank

One of the most compelling aspects of Mountain West Bank is its unwavering focus on customer satisfaction. The bank’s customer-centric approach sets it apart from larger financial institutions, which may prioritize profits over personal service. Mountain West Bank takes the time to understand its customer’s needs, providing personalized recommendations and financial advice tailored to individual circumstances.

The staff at Mountain West Bank are known for being approachable, knowledgeable, and ready to assist with any questions or concerns. Whether you’re a new customer opening an account or a long-time client seeking advice on a financial decision, the team at Mountain West Bank makes it a priority to ensure that your experience is seamless and positive.

The bank’s commitment to building long-lasting relationships with its clients is evident in the level of customer satisfaction it enjoys. Many customers have shared their positive experiences, citing the bank’s dedication to transparency, honesty, and a personal touch in every interaction.

Embracing Technology and Innovation

While Mountain West Bank values its community-oriented approach, it also understands the importance of staying up-to-date with technological advancements in the banking sector. Over the years, the bank has made significant strides in implementing innovative solutions that enhance the customer experience.

This includes the development of a robust online and mobile banking platform that makes managing accounts and transactions easier than ever. Customers can use the mobile app to deposit checks, transfer funds, check their balances, and even apply for loans without needing to visit a branch. This emphasis on technology has been crucial in maintaining the bank’s competitiveness in an increasingly digital world.

Additionally, Mountain West Bank has invested in cybersecurity measures to protect customers’ data. The bank uses state-of-the-art encryption and fraud detection systems to safeguard sensitive financial information, ensuring that customers can trust their accounts are in safe hands.

The Future of Mountain West Bank: What Lies Ahead?

As the financial landscape continues to evolve, Mountain West Bank is committed to adapting to meet the changing needs of its customers. The bank’s focus on customer service, community involvement, and technological innovation positions it for continued success in the years ahead.

One area that is likely to see growth is the bank’s focus on sustainable finance. Many financial institutions, including Mountain West Bank, are increasingly looking for ways to promote environmentally and socially responsible investments. Whether it’s through financing green projects or offering loans to eco-conscious businesses, the bank is expected to play a role in supporting sustainable initiatives.

In the coming years, we may also see the bank expand its range of products and services even further. With a focus on meeting the unique needs of both individuals and businesses, Mountain West Bank will likely continue to innovate and provide new solutions to keep up with the changing financial landscape.

Conclusion: The Enduring Appeal of Mountain West Bank

Mountain West Bank has carved out a strong position in the financial services industry by focusing on what matters most to its customers: trust, service, and community involvement. Whether it’s offering personal banking solutions, supporting local businesses, or investing in technological advancements, Mountain West Bank has proven to be a reliable and forward-thinking institution.

Its growth over the years, paired with its ongoing commitment to the community, makes it a bank that stands out in an increasingly crowded financial marketplace. For anyone looking for a bank that combines modern banking convenience with a deep connection to its customers, Mountain West Bank is a solid choice.